|

Getting your Trinity Audio player ready...

|

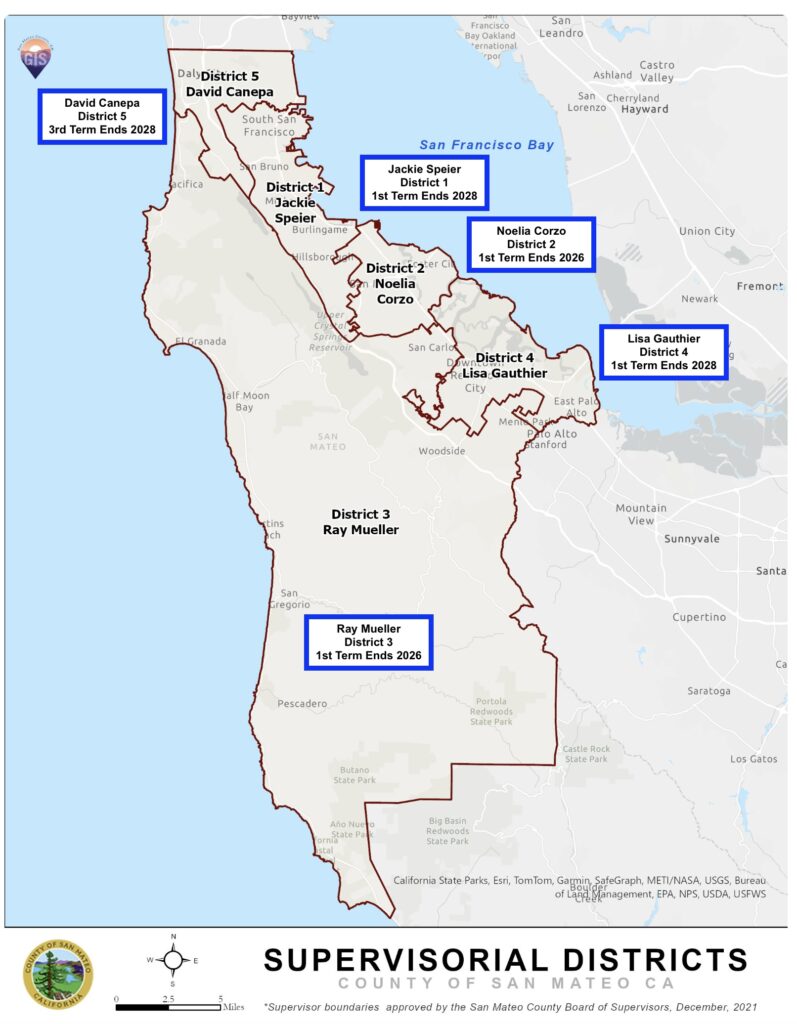

PRESS RELEASE. From the San Mateo County Executive’s Office on January 15th, 2025. And a A Primer on ERAF (Educational Revenue Augmentation Fund) and LCFF (Local Control Funding Formula) and VLF (Vehicle License Fees) from the 2023-2024 SMCo Property Tax Highlights (pages 9-10 or scroll down).

Redwood City – Countywide combined property taxes jumped 8 percent over last year, increasing by $286 million the funds used to help operate local cities, school districts, special districts and the County.

The breakdown of where the $3.9 billion in total property tax went as well as overall financial information and historical trends are detailed in the San Mateo County Controller’s Property Tax Highlights publication for fiscal year (FY) 2023-24.

“It’s important that we provide taxpayers and residents visibility into the local tax dollars they pay and where those local dollars go,” said County Controller Juan Raigoza.

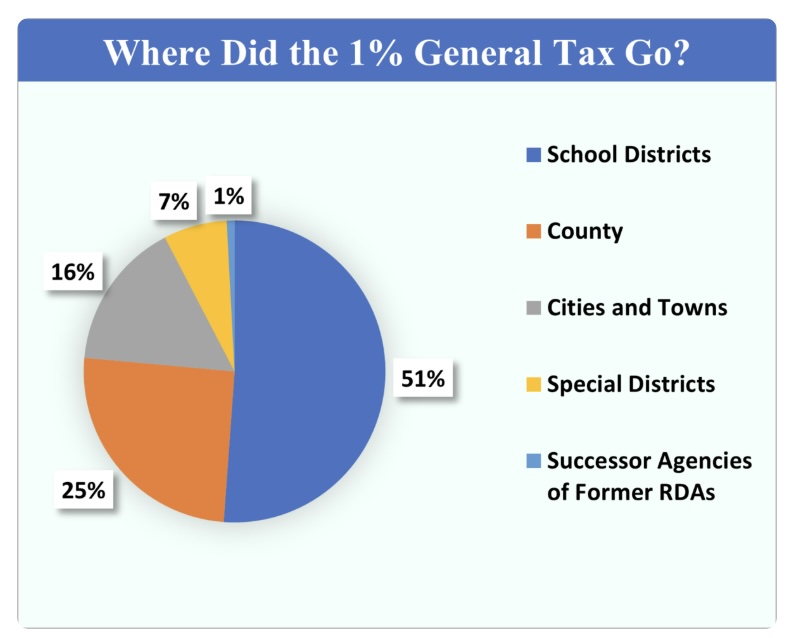

The $3.9 billion consists of the countywide 1 percent General Tax totaling $3.1 billion, $401 million for special charges and $379 million for debt service.

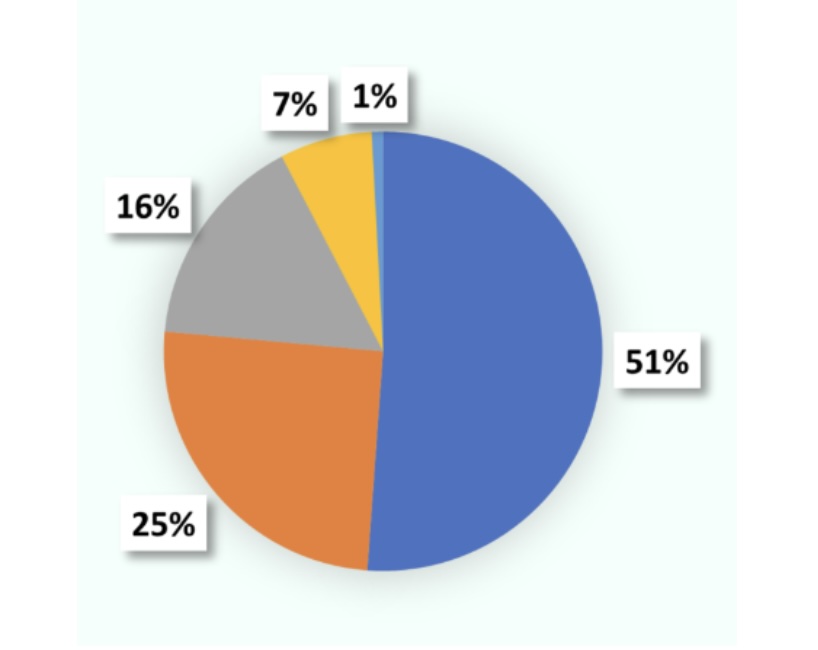

The countywide 1 percent General Tax is central to funding public services provided by local governments to residents throughout the county. About 51 percent of General Taxes collected are distributed to school districts, 25 percent to the County, 16 percent to cities, 7 percent to special districts and 1 percent to successor agencies of former redevelopment agencies.

Special charges totaling $401 million received primarily by cities and special districts are included in property tax bills for services such as sewer maintenance, mosquito abatement and flood control. Additional levies accounted for $379 million which are mostly used to pay for debt service on voter-approved bonds of local school districts.

Another primary source of revenue for public services is the “in-lieu Vehicle License Fee” (VLF). The state provides these revenues to counties and cities instead of the vehicle license registration fees they used to receive. Fees previously received by counties and cities were redirected to the state starting in 2005.

For the seventh year, there is a shortfall between the funds available for VLF and the amounts due to the County and its cities. This includes a VLF shortfall of $114 million for the prior year (FY 2023-24) and a presently estimated $121 million for the current year (FY 2024-25), totaling $235 million. While this is a very significant sum for the County and its cities, from a broad statewide perspective, the $114 million shortfall represents a small fraction —1 percent— of the total $11.5 billion funded by the state for VLF across all counties in FY 2023-24.

In the first three years that a shortfall occurred, the governor and California Department of Finance included funding for VLF shortfalls in the governor’s proposed budgets, appropriating $106.5 million in total for the County and cities to cover those gaps. Unfortunately, the governor’s more recent budgets have not included appropriations for shortfalls.

Although the governor’s proposed budgets did not include appropriations for VLF shortfalls in the prior two years, San Mateo County’s state representatives worked tirelessly to secure full VLF funding in the state’s budgets for those years, totaling $102.4 million, including $70 million for the FY 2022-23 shortfall received this year. Current and former state legislators, including Diane Papan, Phil Ting, Kevin Mullin, Josh Becker, Marc Berman, and Scott Wiener have worked with their colleagues and the governor to secure and protect these essential funds.

While the governor and Legislature have acknowledged the state’s obligations by including VLF shortfall amounts from five different years in the state’s budgets, the process delays receipt of the funds to the detriment of local agencies. Receiving these expected funds two budget years late causes significant disruptions to providing public services.

The governor’s initial proposed budget for FY 2025-26 released last week did not include funding to cover last year’s shortfall of $114 million.

“The County, cities, and their local state representatives should not have to fight, year after year, for this critical revenue source that other California counties and cities receive in full and timely, every year,” Raigoza said.

He added that updating state law so that VLF obligations are fully funded in the year owed would eliminate the need to annually address shortfalls, two years later, through the state’s budget. Local agencies are simply asking the state to provide full VLF funding when due – no new or additional funds that are not already expected are being requested.

“Local agencies should be paid, in a timely manner, like every other county and city in the state so they can continue to provide services to the public,” Raigoza said.

To learn more about property taxes, in-lieu VLF funds, and the County’s finances visit http://controller.smcgov.org/. In addition to the Property Tax Highlights publication, the site hosts the Tax Rate Book which shows assessed property values by taxing agency and property tax rates by tax rate area, and the County’s annual financial reports.

From the Property Tax Highlights San Mateo County Controller’s Office Fiscal Year 2023-24

A Primer on ERAF and LCFF and VLF ~ See pages 9 and 10.