|

Getting your Trinity Audio player ready...

|

OWN VOICE. ~ InPerspective by Gregg Dieguez —

Readers have asked why I can’t get my head out of the sewer, with so many articles on spills and costs and now the exploding bus duct >> that shut down the SAM plant on April 28th, etc. etc. And my answer is: there’s a lot going on down there, and it’s part of the asset foundation upon which our civilization rests – your home values, your business, etc. But let me get ahead of the game with something you haven’t heard about….

What got me involved in public office – community governance was years back when I was analyzing MWSD’s finances. First it was a proposal for a new fire company, instead of using CalFire. Turns out it would have cost at least as much as CafFire, and probably more than that, with zero guarantees about the costs or performance of a new organization. Then it was the Defined Benefit Pension plan at MWSD (which is common elsewhere). At some point in 2018 I got worried about the financial viability of MWSD, so I ran a quick analysis of half a dozen local public works agencies, and forecast out 50 years… and my model told me they were all going broke. And it wasn’t close; it was $100’s of Millions of dollars. So I slapped myself awake and said “You Dummy! Can’t be true! there must be something you don’t understand, do some research!”. So I began what has turned into a 4 year research hobby project into Growth, Infrastructure and Fiscal Sustainability. Since then I’ve interviewed about 100 people, from Professors of Fiscal Sustainability in Switzerland, to the President of a national Architecture group, to public works board members, mayors, consulting engineers, water & waste vendors, lawyers, developers, planners, council and board members, public works GM’s and staff engineers, hydrologists, transportation engineers, professors, town managers, historians, etc. And finally, I’m reaching a conclusion….

I was right. We just saw it in Pacifica, whether you agree with the sea wall in your sewer rate increase or not: $125M in investment required, plus 73% in borrowing cost on every asset financed (i.e. if rates aren’t raised enough to cover the asset costs). And my analysis shows that if Pacifica had charged New Joiners connection fees appropriate to the asset foundation for past decades, they would have had most of the money they needed for their recently disclosed plans! Of course, that assumes the city sewer enterprise would have been able to retain the reserves, instead of having them siphoned off into the City’s General Fund and spent elsewhere. And Grand Jury me no Grand Jury, but that is a problem in a number of cities where the Public Works are merged into the city’s financial management. Pacifica isn’t alone, and I’m going to try to shed light on the iceberg of hidden financial liabilities in public works everywhere, starting with San Mateo County.

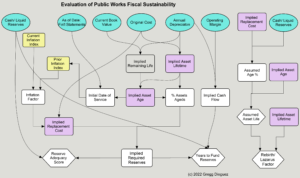

Rather than just remain a curmudgeon howling at the moon about the lack of fiscal sustainability, I’ve devised a summary, or “bird’s-eye view” method of assessing the adequacy of reserves in public works agencies. I’ve previewed my thoughts with two members of the AWWA’s Rates & Charges committee and been asked to submit a paper. And I’m continuing with interviews to refine what I think I know into something credibly agreed by those involved in managing the agencies. But it wouldn’t be polite (and might even be embarrassing to me and/or an agency) to just publish my statistics without first speaking directly to the agencies involved, and I just might learn something more. My goal is to have the AWWA create a national benchmark database on the Fiscal Sustainability of all public works agencies. At present, I don’t see one.

So today, I had my first interview with an agency (one of the better managed ones), and explained my analysis, the conceptual basis, and how I calculated their reserve adequacy score (30.6%) and the difference between their reserves (~$20M) and their required reserves (~$75M)…. and they weren’t surprised! In fact, their internal assessment, which is more current than the 6/30/21 financial data I used, is more like $85M!

I’m also learning that independent public works districts and agencies have better financial analyses than those bundled in with cities. One suspects there will be more than one Grand Jury investigation called for regarding Cities that transfer designated reserves from water or sewer enterprises into their general fund. One wonders if it’s intentional to leave things disorganized and ambiguous so that City inter-fund transfers can be facilitated.

So stay tuned for a Fiscal Sustainability assessment of YOUR local public works agency, after I have discussed my approach with each of them, and ensured that I’m not missing something unique to their situation (and I can tell you that EVERY situation seems unique). And then we can discuss what we’re going to do about the invisible iceberg of liability beneath our streets.

More From Gregg Dieguez ~ InPerspective

Mr. Dieguez is a native San Franciscan, longtime San Mateo County resident, and semi-retired entrepreneur who causes occasional controversy on the Coastside. He is a member of the MCC, but his opinions here are his own, and not those of the Council. In 2003 he co-founded MIT’s Clean Tech Program here in NorCal, which became MIT’s largest alumni speaker program. He lives in Montara. He loves a productive dialog in search of shared understanding.