|

Getting your Trinity Audio player ready...

|

ARTICLE. City of HMB Fiscal Year 2018/19 Second Quarter Financial Report.

The purpose of this report is to provide the Council and the public with an overview of the City’s general operating revenues and expenditures for the first half of the fiscal year compared to the annual budget. The focus of this report is the City’s General Fund which is the primary operating fund of the City and is used to account for most operating activities.

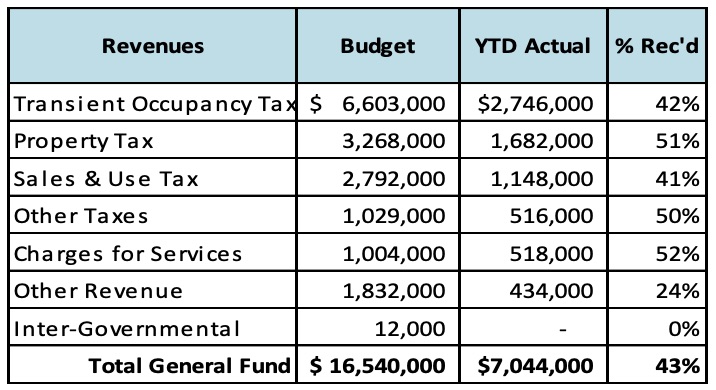

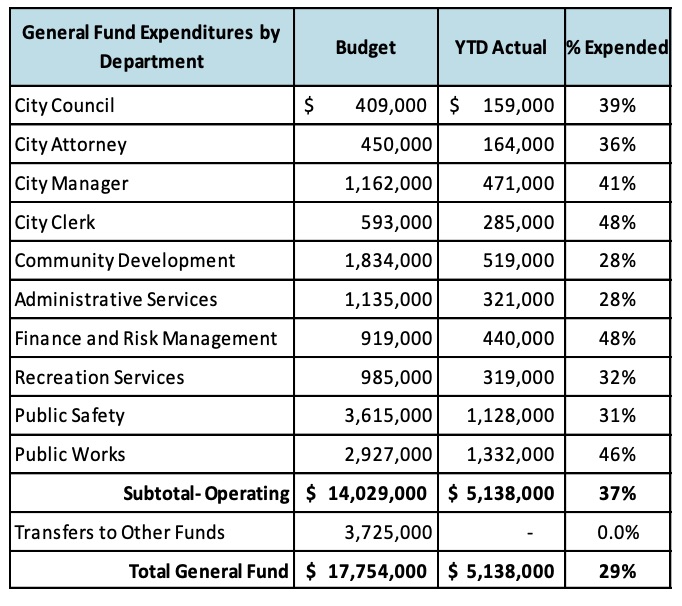

GENERAL FUND. General Fund Financial Condition. At mid- point of the fiscal year, General Fund operating expenditures are at 37% of budget (vs. 41% in the prior year). The revenues are at 43% of budget  estimates (vs. 41% in the prior year). The reason for low percentages is that this report is on a cash basis and as a result it includes only the revenues received and the expenditures paid by the end of December. Expenditures. Operating expenditures are running below budget as of the end of the of the first half of the fiscal year. The following chart summarizes expenditures by department:

estimates (vs. 41% in the prior year). The reason for low percentages is that this report is on a cash basis and as a result it includes only the revenues received and the expenditures paid by the end of December. Expenditures. Operating expenditures are running below budget as of the end of the of the first half of the fiscal year. The following chart summarizes expenditures by department:

Transient Occupancy Taxes (TOT). TOT continues to be the largest source of revenue for the City. Since TOT is remitted approximately 30 days after the end of each month and are generally forwarded to by the consultant to the City in the subsequent month, second quarter numbers reflect only four months (July through October) of revenue. TOT revenues are higher in the first part of the fiscal year due to summer tourism activities. Less than 2% of the TOT revenue is attributable to short-term rentals Property Tax. Property Tax is the City’s second largest revenue source. The first major apportionment of property taxes was received in December and the City has received close to the expected amounts in this category. Sales and Use Tax. Sales and Use Tax is the City’s third largest revenue source. As of December 31, 2018, the City has received about 41% of the budget for this revenue. Sales taxes are generally paid two months in arrears and therefore four months of sales tax has been received as of December 31, 2018.

Other Taxes. This includes Franchise Tax and Business License Tax. These revenues combined are at 50% of budget. Most of franchise taxes are received in the second half of the fiscal year, while business license taxes are received mostly in the first half of the fiscal year. Business licenses taxes are due in October of each year and for the period October 1 through September 30 of the following year.

Charges for Services. These include building permits, engineering and planning fees, and police services. Permits and planning fees tend to fluctuate based on the timing of larger projects. The City has received about 52% of the budget or this category as of the end of December.

Other Revenues. The main components of this category are golf and parking fees, reimbursements, allocations from other funds, and interest income. As of the end of December, the City has received about 24% of the budgeted revenues. Most revenues in this category are received in the second half of the fiscal year.

Inter-governmental. This revenue category includes vehicle code fines, governmental grants and cost reimbursements.

Fund Balance. The total General Fund balance at the beginning of the fiscal year was $10M. Based on the six months actual results and projected budget savings and revenue increases for the remainder of the fiscal year, the fund balance is projected to improve and be closer to $11M at June 30, 2019, the end of the current fiscal year. Of this amount $6.3M is committed to Contingency Reserve ($4.8M) and Main Street Bridge ($1.5M). The improved fund balance will position the City favorably as we start preparing the 2019-20 budget. We will discuss the use of fund balance during the budget process for one-time uses such as improving reserves and capital projects.