|

Getting your Trinity Audio player ready...

|

VIDEO. From the Half Moon Bay City Council meeting on Tuesday, May, 21st, 2024 at 7:00pm, as a hybrid meeting.

Full Agenda Staff Report

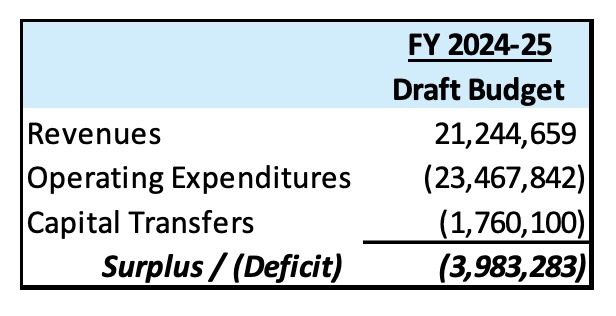

The Deficit and Balancing Options

Should the Council approve the draft budget as is the City will have a structural deficit of $3.9 million going into Fiscal Year 2024-25. The following are short-term options available to the City that can mitigate the deficit for a single year:

Should the Council approve the draft budget as is the City will have a structural deficit of $3.9 million going into Fiscal Year 2024-25. The following are short-term options available to the City that can mitigate the deficit for a single year:

• Use of Unassigned Funds As mentioned above, staff anticipates ending the current fiscal year with unassigned fund balance. These funds can be used to help balance the deficit for the following year. However, this is essentially a one-time and temporary solution, as unassigned funds result from unexpected savings during the previous year. The estimated amount available is $1.6 million.

• Use of the Economic Uncertainty Reserve Created in 2020, this reserve was set aside with one of the allowed uses to prevent a reduction of required services during economic downturns. This reserve has $4.4 million available.

• Use of the General Fund Reserve This reserve was set aside with one of the allowed uses being to respond to unexpected expenditure requirements or revenue shortfalls. This reserve has $6.6 million available.

Receive an informational update and provide policy direction on the development of the Fiscal Year 2024-25 Operating Budget.

The following are longer-term options available to the City that could directly address the structural deficit.

• Sales & Use Tax Increase As a result of research throughout the year with the Finance Subcommittee, a Sales & Use Tax increase appears to be the most advantageous revenue enhancement option available to the City. If approved by voters, this may generate an additional $2 million per year.

• Parcel Tax Increase The Finance Committee also expressed interest in a parcel tax. After more research and developing a potential tax structure, the City may generate approximately $1 – 1.6 million. However, due to the higher voter requirements and an expected parcel tax increase from the school district, Staff is not recommending this pathway.

• Investment in Tourism With flattened tourism and associated Transient Occupancy Tax and Sales Tax revenues, expanded strategies to increase overnight visits to Half Moon Bay are crucial to the local economy and the City budget. The City formed a Hotel Business Improvement District (BID) in 2004 that adds a nightly fee to overnight hotel visitors which is then utilized to promote lodging at local hotels, administer marketing programs that increase overnight lodging, and fund other BID-related activities. The Chamber administers the BID program and budget. The assessment rate has been flat for the entire 20 years of the BID, with annual revenues only increasing minimally, while costs to advertise have increased significantly. This year the Chamber, BID members, and City have discussed increasing the assessment fee to improve the budget, allowing for expanded marketing and promotion of the Coastside, with the aim of increasing overnight visits to hotels, as well as more patronage of local businesses and services. Additionally, the Chamber plans to commission a visitor study and refresh the BID’s marketing strategies by releasing a request for proposals for digital and print media services.

• Investment in Economic Development Following implementation of the Coastside Recovery Initiative, the City, County, and local partners have invested in strategies to expand and diversify the local economy, with an aim at making the coast more economically resilient, adding new and improved local jobs, and ultimately increasing tax revenues to the City. Continued investment in the Opportunity Center and its workforce development, small business/entrepreneur support, and business incubator services will be crucial to create the future economy of the Coast and add new revenues to support City operations. The completion of the Downtown Streetscape Master Plan provides the City with a road map for downtown revitalization. Some design concepts from the Plan such as a gateway arch at the intersection of Highways One and 92 are intended to spur greater economic activity by directing residents and visitors to the City’s primary business district.

• Deeper Cuts to Services and Operations Staff have made cuts in operating expenditures with a focus on saving ongoing costs while not significantly impacting important City services or programs valued by the community. Absent increased revenues in the next few years, the City will need to make more significant cuts which will likely impact the quality of life for residents of Half Moon Bay, focusing expenditures on the most basic core services that the City is required to provide.

City of Half Moon Bay Looks for Revenue Generation after Sheriff Costs Increase 43%; Parcel Tax Could Raise $4.5M to $6.5M and Sales Tax $1-2M

Subscribe

To sign up for Agendas, Weekly eNewsletter, Project Updates, News Releases and more – register and subscribe here.

You can also sign up for email and text alerts regarding City alerts, calendar events, bid postings and news announcements.

Half Moon Bay City Council Meetings ~ 1st & 3rd Tuesdays @ 7:00pm

The Half Moon Bay City Council typically meets on the first and third Tuesday of each month starting at 7pm at the Ted Adcock Community Center, 535 Kelly Avenue. The meeting is also remote by Zoom, Facebook and PCTV. Regular meeting agendas are posted 72 hours in advance. Special meeting agendas are posted 24 hours in advance.

SUBSCRIBE to HMB’s Agendas, Weekly eNews, Project Updates, City alerts, Calendar Events, Bid Postings.

HMB City Council Agendas and Zoom Links

HMB City Council Meeting Videos on PCTV

The City Council of Half Moon Bay is the City’s governing body, and consists of five elected members. The Council sets priorities and policies, makes final decisions on all major City matters, adopts ordinances and resolutions, appoints the City Manager and City Attorney, and approves the annual budget.

The City of Half Moon Bay holds district-based elections for its five city council seats. Each Councilmember is elected to a 4 year term. There are no term limits in Half Moon Bay. The City Council selects one of its members to serve as Mayor and one to serve as Vice Mayor, on an annual basis.

The Half Moon Bay City Council typically meets on the first and third Tuesday of each month starting at 7 pm at the Ted Adcock Community Center, 535 Kelly Avenue.

- streamed live on Comcast Channel 27 and Pacific Coast TV website

- and on Facebook Live

- one in English (City of Half Moon Bay FB Page)

- one in Spanish (City of Half Moon Bay Recreation FB Page)

Members or the public are welcome to submit comments (in accordance with the three-minute per speaker limit) via email to jblair@hmbcity.com prior to or during the meeting, via Facebook live during the meeting, and via two phone lines during the meeting – (650) 477-4963 (English) and (650) 445-3090 (Spanish). The City Clerk will read all comments into the record.

Please visit our “Commenting at a City Council Meeting” information page. You can also learn about City Council Procedures and Decorum.

The City Council develops Strategic Elements to help focus the City’s actions and work plans on its key priorities.

City of Half Moon Bay District-based Elections Map for 2024

Map 503b Adopted 3.15.2022