|

Getting your Trinity Audio player ready...

|

OWN VOICE. ~ InPerspective by Gregg Dieguez —

My recent articles about the fiscal UN-sustainability of our local cities and public works require solutions, in addition to exposure of the deficits. To that end, a friend gave me a book which describes the similar fiscal struggles of cities all over the country, and which recommends solutions. That book is Strong Towns, by Charles Marohn. Let’s build upon one example from his book and contrast it with our local governmental efforts…

Footnotes: to use, click the bracketed number and then click your browser Back button to return to the text where you were reading.

Images: Click to enlarge for improved readability in a new window.

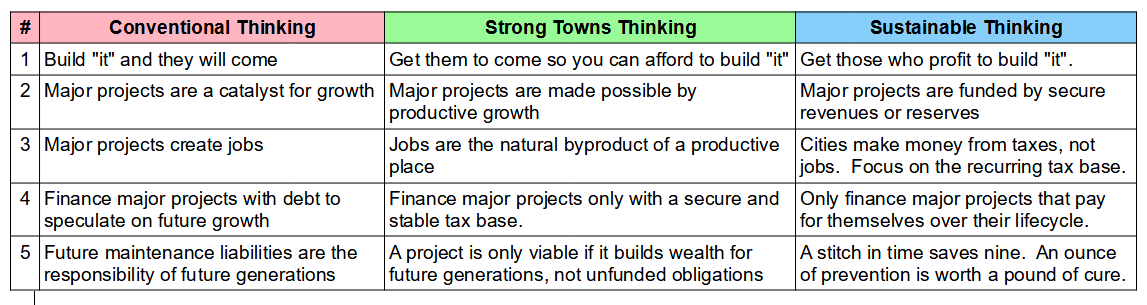

There are multiple reasons we face tens of millions to billions of dollars in unfunded looming liabilities in our cities and public works. Let’s just focus on one of them here: Attitude. The enclosed table from Strong Towns[1] shows what Marohn depicts as Conventional Thinking, then Strong Towns thinking, and I’ve added a column for Sustainable Thinking.

Row #1 depicts what I call the prevalent “Field of Dreams Thinking”, built “It” and they will come. At present, whether it’s the State of California (High Speed Rail), County (County Office Building) or our local cities (Pacifica: seawall, town hall; Half Moon Bay: library, park, gondola), our governments are risking taxpayer monies for non-essential projects that might or might not pay for themselves. The risk is on you, the taxpayer. It’s easy for elected officials to risk our money, because it’s not theirs, and they typically won’t be in office by the time things go wrong. But our governments are taking these chances with your money without any guarantees, and leaving us to pay for the unprofitable mistakes they are creating. The most obvious abuse of this type was funding stadiums for sports teams, something fortunately largely stemmed here in California. Those stadiums put perpetual risk on the taxpayers, without guarantees sufficient to pay for the full life-cycle of the assets, and without profit-sharing. I’ve yet to see a Fiscal Sustainability Analysis for any of the projects mentioned above, an analysis which shows how revenues will cover all expenses for the entire lifetime (and disposition) of the assets and liabilities created. And even if there were a Return On Investment forecast, there would be no guarantees under current practice. So why should our governments be risking our money? If there’s profit to be made, let those who will profit make the investment and enjoy the profits, or risk the losses. There are business people who know how to do this. They do it very well. That’s why there are plenty of rich people.

Clearly the financial condition of our local governments shows they do not know how to ensure a good ROI. Half Moon Bay built a nice library it couldn’t afford to pay for. Pacifica is proposing a $100 million seawall project based on an analysis of property value losses… that aren’t the City’s properties – while ignoring any analysis of the tax revenues, which ARE the real revenues at risk to the City. Is your city planning to remodel a town hall while projecting a financial deficit and draining its reserves? How exactly is a better town hall going to improve the financial condition of your city? Does your city have all the reserves needed to fund replenishment of essential public works, so that it can spend the excess on discretionary projects? No, they do not, as we demonstrated here. You can see how unhinged from financial reality the financial management practiced by our local governments is.

What is needed to start is a new attitude toward fiscal sustainability. More than that, certainly, will be needed. But as a start, our governments have to tie their investments to guaranteed returns, or else get someone else to fund the investments and earn the returns. The idea that HMB would allow an investor a ‘concession’ to build and operate a gondola would seem to be a step in the right direction – as long as the taxpayers aren’t risking their money. Let the risks and the profits be taken by the professionals who know how to plan and attain an ROI. Stop spending taxpayer money on discretionary projects without guaranteed returns.

FOOTNOTES:

[1] Strong Towns by Charles L. Marohn, Jr., Table 9.2, page 186.

More From Gregg Dieguez ~ InPerspective

More From Gregg Dieguez ~ InPerspective

Mr. Dieguez is a native San Franciscan, longtime San Mateo County resident, and semi-retired entrepreneur who causes occasional controversy on the Coastside. He is a member of the MCC, but his opinions here are his own, and not those of the Council. In 2003 he co-founded MIT’s Clean Tech Program here in NorCal, which became MIT’s largest alumni speaker program. He lives in Montara. He loves a productive dialog in search of shared understanding.